The Job Market Explained in 2 Words – Supply and Demand

- April 4, 2023

- Savannah Higgins

- Uncategorized

- No Comments

Labor Market Overview

Despite the economic conditions we’ve seen since the pandemic, the labor market continues to be tight. The most recent release from the Bureau of Labor Statistics has overall unemployment at 3.6% or 5.9 million people. For context, the unemployment rate at the height of the financial crisis in 2008 was 10% and remained there for several years. Prior to the start of the pandemic the rate was 3.4% (February 2020). If we’re at roughly the same rate today as we were at the beginning of 2020, why is it more difficult to find qualified candidates in today’s market? It all comes down to Supply & Demand.

Labor Supply

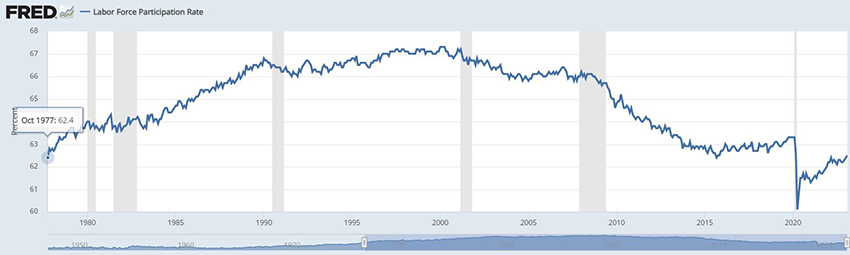

The labor force participation rate is defined as, “the number of people in the labor force, defined as the sum of employed and unemployed persons as a percentage share of the total working age (16+) population.” This rate currently is at the same participation levels as October 1977. How can we have historically low unemployment and historically low labor force participation? There are quite a few differences between the two calculations, but the major contrast is, “unemployment rate doesn’t consider persons who haven’t actively sought employment in the trailing four weeks.” Between February 2020 and January 2021, a net of 5.5 million people dropped out of the labor force and haven’t returned. Surveys site reasons for dropping out to include family care, early retirement, and illness. Even though unemployment is low, it’s not the full story of those who have left the labor force and have yet to return.

Labor Demand

The demand for labor in all sectors has sky rocketed since the initial pandemic shock. Many industries saw tremendous growth during the aftermath as demand came back from consumers and businesses. Many industries over-hired during this period and have begun laying off those employees who were most recently hired. So far, this has been sequestered to big tech companies and recently the fintech banking sector, but overall remains low. There are numerous factors that could bring job openings down. For example, if the Fed continues to raise interest rates with high velocity, we expect this trend to decelerate as companies plan to operate in a high interest environment for longer than expected.

Summary

The demand for labor has been outpacing the supply for the better part of 2 years. Where you used to see 20 applications for a job posting, you’re likely getting 5 now; by the time you contact the qualified candidates, they’re likely off the market. The Fed has been focused on bringing down inflation and, as a result, increasing unemployment. The Fed recently warned that 5% unemployment is likely in 2023 as they push forward with their mandate to tighten monetary policy and raise interest rates. Current events could put a pause on their hikes, but inflation is the elephant in the room and remains persistent. Everything is on the table for 2023, and that includes raising unemployment to loosen the current tight labor market conditions and bring job openings down in tandem. It’s been an eventful 1st quarter in 2023, and you can expect it to continue throughout the year.

Written by: Justin Jocelyn

Click to view live chart.

Click to view live chart.